Renters Insurance in and around Roanoke

Your renters insurance search is over, Roanoke

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Huntington

- Fort Wayne

- Andrews

- Wabash

- North Manchester

- Peru

- Angola

- Markle

- Indianapolis

- Bloomington

- Anderson

- Auburn

- Decatur

- Marion

- Warsaw

Home Is Where Your Heart Is

It may feel like a lot to think through your busy schedule, your sand volleyball league, managing your side business, as well as savings options and deductibles for renters insurance. State Farm offers straightforward assistance and remarkable coverage for your sports equipment, sound equipment and linens in your rented space. When the unexpected happens, State Farm can help.

Your renters insurance search is over, Roanoke

Renters insurance can help protect your belongings

Why Renters In Roanoke Choose State Farm

You may be wondering: Is renters insurance really necessary? Think for a moment about how difficult it would be to replace your belongings, or even just one high-cost item. With a State Farm renters policy backing you up, you don't have to worry about fires or break-ins. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've stored in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Kris Luebke can help you add identity theft coverage with monitoring alerts and providing support.

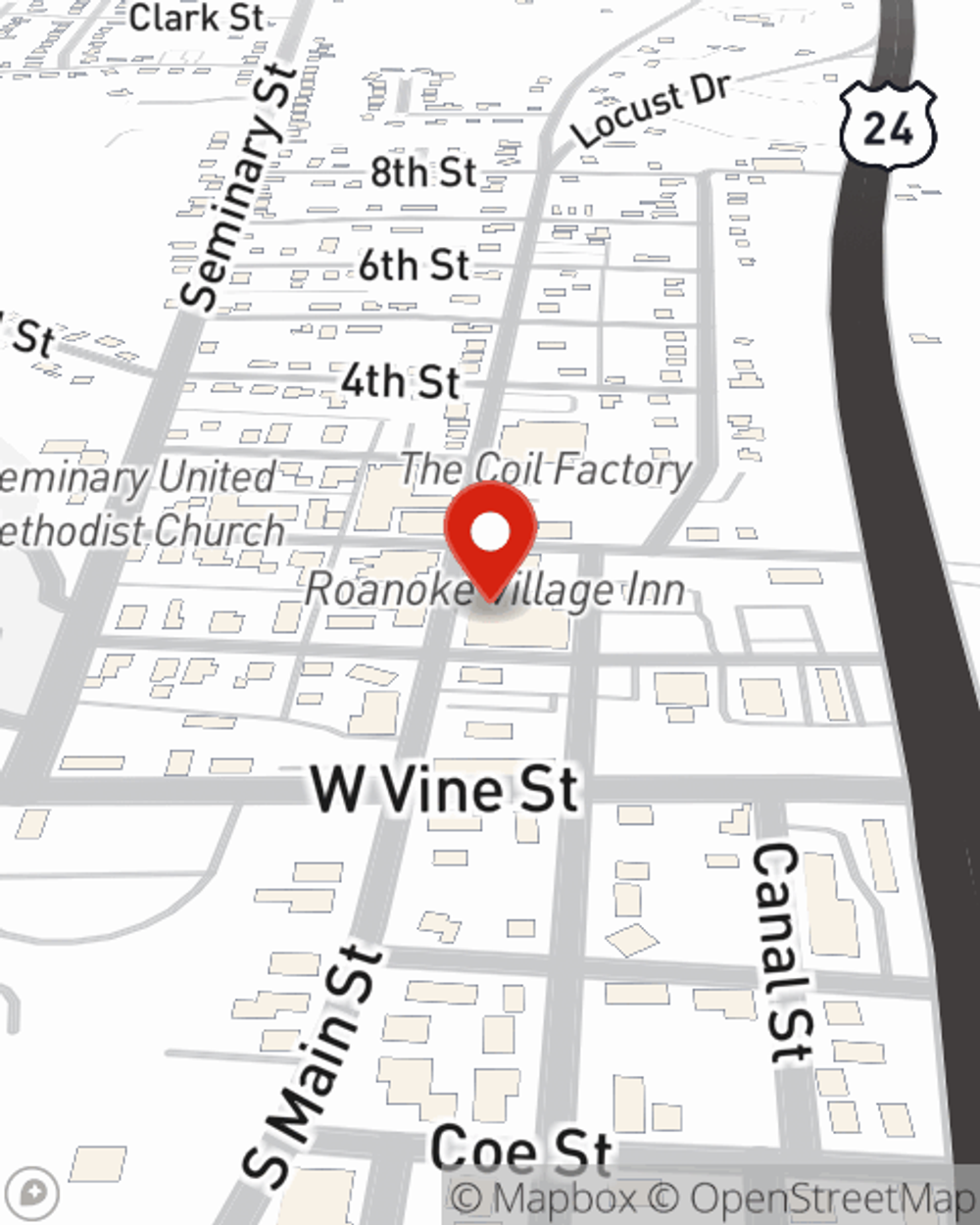

State Farm is a committed provider of renters insurance in your neighborhood, Roanoke. Reach out to agent Kris Luebke today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Kris at (260) 672-2951 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Kris Luebke

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.